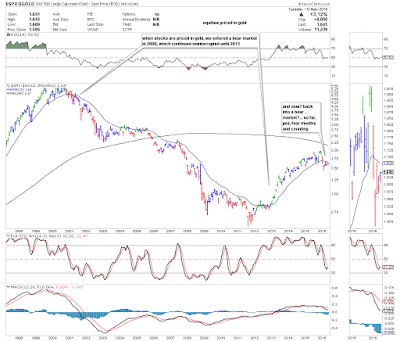

Then on the other hand, a view of where we are in the process of a bear market progression if equities were priced in gold instead of dollars. Dollars can be printed (devalued), gold cannot, it's value is much more stable.

Well, the gov better get busy with helicopter money next...QE on steroids.

davewave

The most powerful human attribute is imagination. The second most powerful is a good bullshit detector.

Wednesday, May 11, 2016

bear market definition, and where we are in the process

Seems like a good time to update the bear market chart, using my favorite definition, sequential closes below the 20 month EMA (can be applied to anything). A long enough period of sideways eventually also gets "bear market" designation, later in the game. Meanwhile, in up-down terms, this IS NOT a secular bear market, measured in (devalued) US Dollars. Not yet anyway.

Wednesday, June 10, 2015

the mothers milk of speculation

David Stockman pretty much nails it in this one single post - perhaps the best summation of the corrupt state of our government I have seen in years of watching. The condition we find ourselves in is nothing unusual in the history of the world, it's the life cycle countries have gone through since time immemorial. But it is unusual in the history of this, our, country. If you're young, fasten your seat belt, the ride is going to get bumpy.

http://davidstockmanscontracorner.com/the-warren-buffet-economy-why-its-days-are-numbered-part-1/?utm_source=wysija&utm_medium=email&utm_campaign=Mailing+List+PM+Monday

http://davidstockmanscontracorner.com/the-warren-buffet-economy-why-its-days-are-numbered-part-1/?utm_source=wysija&utm_medium=email&utm_campaign=Mailing+List+PM+Monday

Thursday, June 26, 2014

VIX interesting lately

click to enlarge

VIX sell signals - when VIX touches the bottom Bollinger on the daily chart, with correspondence to SP500 below.

VIX has fired a rash of sell sigs in rapid succession recently, afaik this is historically unprecedented. If this sort of thing continues it lends credence to idea the Fed and PPT (President's Working Group, aka plunge protection team) have the market in "lock down" mode.

If they buy every dip immediately the market can only go sideways or up. A market that can only go sideways or up is going to go up.

Seems plausible to me they have the monetary firepower and trading mechanisms in place to put this market into a nearly straight line of pretty much any angle they choose. But even if so they have to allow for some volatility to keep up appearances, and it takes a black swan of considerable girth to move this market in the down direction substantially.

Sunday, September 8, 2013

Shiller does it again?

One of the few prominent establishment economists warning of the US housing bubble as early as 2005, now saying housing bubble in BRICs and Canada (primarily).

Could be the predicted "backwall of the hurricane". Are the so-called "fortress balance sheets" (printed up courtesy the Fed, some would argue, for this express purpose) of US banks enough to weather another melt down? European banks are certainly vulnerable. If Europe and emerging markets collapse the US might be the port in the storm, even as it gets hit too.

Friday, May 31, 2013

The Sustainability of Debt

Debt is being lowered, the problem is credit is being created faster. Printing has recently created all time highs in many key metrics for total credit outstanding.

Most don't look at the final stage of hyper-inflation as a deflation. That's all it is, currency flames out completely and credit collapses completely. After the hyperinflation a deflationary depression ensues. The currency turned toilet paper no longer exists. In the new currency there is an economic depression. Economic depression and deflation are the same thing, and an organic phenomena, but the artificial mechanism of hyperinflation obscures this to some extent. It's artificial in the same sense as when we hear "prices are artificially set" these days.

True, with fiat currency a "hyperinflationary depression" occurs in the run up to the final credit bust. During that period the economy ceases to function well and folks can't get goods - it's a depression. After the bust a re-set (new currency) is necessary, and what comes after that is a continuation of the same economic depression that started during the hyper-inflationary phase. To citizens on the street there's no difference - couldn't get goods before or after. But in formal terms it is no longer a hyper-inflationary depression, now it is a deflationary depression.

Printing in the early case is political policy response to disinflation, to goose the economy. But when printing has less multiplier in the economy (which occurs as total levels of credit increase) more printing is required. The problem is liquidity trap dynamics create a situation of zero (or even negative) multiplier, and in the extreme case hyperinflation can ensue if Central Bankers continue ramping. In a negative multiplier economic conditions worsen even more quickly as printing goes parabolic. This is where the CB is only having negative impact on economy, but continues anyway.

There can only be two reasons a CB would continue in that case - psychological denial and/or ignorance of the soon to come unintended consequences, or willful destruction of currency (informal default on debt). In the latter case destruction of the currency would obviously be seen as the least bad choice available.

We live in a more complex world. For one thing a hyper-inflation in a major currency has never happened. For another, while it's easy to ascribe previous hyper-inflations to ignorance and denial, in this day of better economic measures that excuse can't credibly be used. Finally, as far as we know no one is deliberately trying to destroy USD, EUR or JPY. USD especially, at least as long as it is reserve currency, and why would US want to give up that advantaged position?

I think what B and the Boyz are doing is their best to preserve status quo. At some point the addiction to growth ruled out the sensible policy of allowing organic contractions to occur. There were and are many academic rationales supporting this stupidity.

But the base case is this: unsustainable debt levels by definition end in deflation, ie, the collapse of credit leading to economic depression. The mechanism of printing to create inflation (more credit) always fails sooner or later - if the debt is truly unsustainable. The game can go on as long as the debt is sustainable. It's that simple.

So a lot of people (me included) throw the term "unsustainable debt" around as if we know it's true. Well, that's wrong, we won't know it's unsustainable unless it collapses dynamically, in a rapid process policy has no effect on. As long as policy continues to be effective - debt is sustainable.

Hyper-inflation, when it occurs, is a sure sign debt is no longer sustainable. At that point it becomes obvious it will collapse in relatively short order.

Tuesday, February 28, 2012

LOGIC

Money: that medium of exchange

that represents "wealth".

Wealth: 1) material resources 2) innovation 3) labor, in some combination.

For money to "function" properly it has to possess 3 qualities:

1) portable and durable,

2) stable store of value,

3) reliable unit of account,

and since the Fed is subverting qualities 2 and 3, price charts in dollars are not accurate in the measure that counts - "real wealth = purchasing power".

This is a problem solved using gold as the measure instead of the dollar. Why gold? It's the time immemorial collective unconscious "anchor". It is the market most sensitive to "induced" inflation.

Certain markets are better at sniffing out fundamental conditions than any formal codified measure we have. Try as we might, we cannot codify the dynamic collective unconscious (which shouldn't be too surprising).

(Not so) incidentally, this is the single reason free markets, in all their glorious organic splendor, are more efficient than any formally codified system of economic organization. Unfortunately free markets have ceased to exist in the developed west some time ago. Those railing against "free markets" are actually railing against a nascent fascism.

Wealth: 1) material resources 2) innovation 3) labor, in some combination.

For money to "function" properly it has to possess 3 qualities:

1) portable and durable,

2) stable store of value,

3) reliable unit of account,

and since the Fed is subverting qualities 2 and 3, price charts in dollars are not accurate in the measure that counts - "real wealth = purchasing power".

This is a problem solved using gold as the measure instead of the dollar. Why gold? It's the time immemorial collective unconscious "anchor". It is the market most sensitive to "induced" inflation.

Certain markets are better at sniffing out fundamental conditions than any formal codified measure we have. Try as we might, we cannot codify the dynamic collective unconscious (which shouldn't be too surprising).

(Not so) incidentally, this is the single reason free markets, in all their glorious organic splendor, are more efficient than any formally codified system of economic organization. Unfortunately free markets have ceased to exist in the developed west some time ago. Those railing against "free markets" are actually railing against a nascent fascism.

Fascism: where the protection of an established oligarchy becomes

higher priority than protection of individual rights. In other words, the

middle class gets taxed out of existence so the oilys don't lose their wealth. (We are early in that

process, and the middle class remains, for the most part, blissfully unaware.)

I suppose the

progression from free to oppressed is predicable and unavoidable.

Regardless, it is lamentable!

This "most sensitive" rule of markets does not apply to all markets all the time (obviously), but it always applies to some market all the time. Even in economically repressive regimes this "sniffing out" function occurs spontaneously in so called black markets (really just organic conditions under economic repression). As long as we have the power of our organic brains unimpeded, this will be the case.

Clearly, gold is still functioning as best measure of real wealth. Click for larger:

This "most sensitive" rule of markets does not apply to all markets all the time (obviously), but it always applies to some market all the time. Even in economically repressive regimes this "sniffing out" function occurs spontaneously in so called black markets (really just organic conditions under economic repression). As long as we have the power of our organic brains unimpeded, this will be the case.

Clearly, gold is still functioning as best measure of real wealth. Click for larger:

Subscribe to:

Posts (Atom)